Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

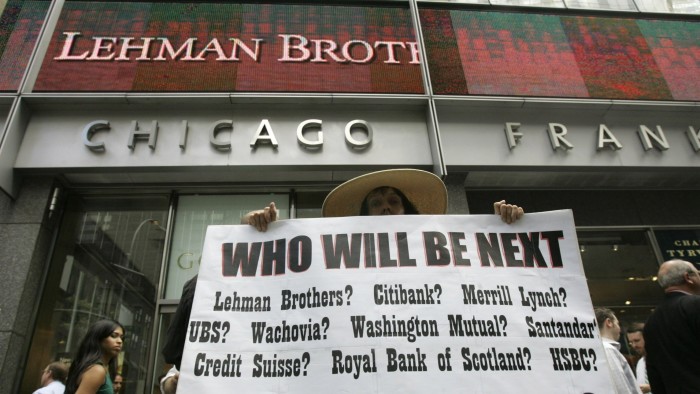

Happy Lehman Brothers Day to those who celebrate. It’s the 17th anniversary of what remains the largest bankruptcy in American history.

But with each year’s passing, a little more of the story is forgotten. Link-rot has erased the cache of Lehman emails and memos released in 2011 by law firm Jenner & Block to accompany its coroner’s report. Lehman’s own investment research silo is long gone, as are those of numerous contemporaries. Finding files on Internet Archive is sometimes possible, but is slow and unreliable.

People really shouldn’t be so careless with history. For that reason, we’ve scanned a very old HDD for Lehman-related research notes, etc, and uploaded some of the files. Everything’s from 2008.

Our purpose isn’t to offer a comprehensive view of the Great Financial Crisis, nor even a particularly insightful one. All we’re doing is trying to preserve stuff against online erosion. Maybe some of the files archived below will be useful to a financial historian, while everyone else can think of them as digital memorabilia.

-

Here’s a Lehman sell-side note from February 12 on leveraged loans, CDOs and subprime exposure at the large US banks, excluding itself. And here are Lehman’s briefing notes for the securitised products team’s weekly call of August 27, which includes IndyMac loan default scenarios.

-

Here’s a note from Lehman’s banks analyst Jason Goldberg dated September 19, four days after the bankruptcy, that talks about that day’s dead-cat bounce for the sector on hopes of asset nationalisation and short-selling bans. Goldberg was transferred to Barclays, where he remains.

-

Here’s a note from Morgan Stanley dated June 30 that initiates coverage of Lehman Brothers with an “overweight” recommendation, which it reiterated on July 14 and August 27. The lead author, Patrick Pinschmidt, left Morgan Stanley in 2009 and joined the Congressional Oversight Panel for market monitoring, regulation and TARP management, then spent five years at the Treasury Department, where he was first executive director of the Financial Stability Oversight Council.

In 2014, Pinschmidt told the House Committee on Financial Services that his “wrong call” was a symptom of how much “the market misjudged the impact of Lehman’s failure in terms of counterparties [and] other institutions”. He’s now a tech VC.

-

Here’s a note from Fox-Pitt, Kelton’s David Trone dated July 14 in which he argues that Lehman has been targeted by rumour-mongering short sellers and its best course of action would be to go private, “since it is the public equity markets that are the threat to the company’s survival”. Trone remained hopeful about a rescue by sale or restructuring on September 9. He now does investor relations.

-

Here’s a brief note dated August 28 from Dick Bove, a now-retired superstar banks analyst, recommending clients of Ladenburg Thalman buy Lehman shares based on the prospect of a takeover.

-

Disastrous quarterly results from Lehman on September 10 made clear that something had to happen imminently, though no one was prepared to guess what. That meant a lot of “hold” recommendations. Here’s fence-sitting from JPMorgan (September 10), Oppenheimer (September 10), Bernstein Research (September 11), UBS (September 11), KBW (September 11), Sandler O’Neill (September 11), HSBC (September 11), Bank of America (September 11), and Merrill Lynch (September 11).

-

Here’s a Deutsche Bank sector note about banks’ wholesale funding risks and capital adequacy from analyst Mike Mayo dated September 15, the same day Lehman filed for bankruptcy. It repeats a “hold” on the shares. Mayo’s now at Wells Fargo.

-

Here’s Albert Edwards at SocGen with an “economic and equity market meltdown imminent” alert to clients dated September 4, followed by a “recent events should not come as a surprise” follow-up dated September 18. Edwards is still at SocGen.

-

Still on the strategy side, here’s Citigroup hitting the wall of worry on September 15, UBS appealing for calm on September 17, and JPMorgan calling the bottom for equities approximately five months too early on September 19.

-

Finally, the HDD scan also turned up this picture of former FT Alphaville reporter Tracy Alloway on the morning of September 15. Alloway’s current whereabouts are not known.

You’re invited to send us additions and copyright takedown notices by email.